By Tony Obiechina, Abuja

The Federal Government says it is determined to reverse the country’s negative assets liability which stands at N39 trillion.

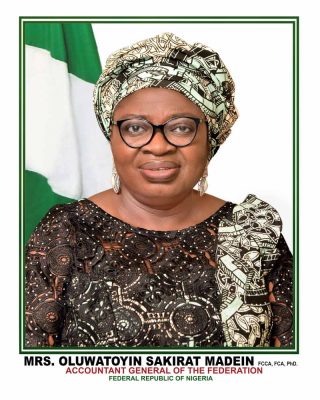

The Accountant General of the Federation (AGF), Dr. (Mrs) Oluwatoyin Madein disclosed this on Tuesday at a one-day sensitization workshop on National Assets Register and the Strategic Importance of Legacy Asset Rendition in the Implementation of International Public Sector Accounting Standards (IPSAS) Accrual basis Accounting in Nigeria held in Abuja.

The workshop with the theme: “Legacy Assets Rendition and Preparation of Stand-Alone Financial Statements by MDAs was organised by the OAGF for directors of finance, internal audit and heads of accounts of Ministries, Departments and Agencies (MDAs).

She said the reason it appears as though Nigeria has more liabilities than assets is because the country has not been able to collate, evaluate and place value on the assets of the federal government.

She said that Nigeria adopted IPSAS accrual accounting with effect from 1st January 2016 but till date many legacy assets have yet to be recognized, measured and uploaded.

“Consequently we still have huge negative net assets in our 2021 consolidated financial statements which stood at N39 trillion,” she said.

Mrs. Madein said the strategic importance of legacy asset rendition cannot be overstated. But unfortunately, the pace of rendition by MDAs has been disappointingly slow. “This delay hampers the timeliness and accuracy of the consolidated financial statements and significantly impacts our ability to address the net asset deficit as expected.

She said the federal government has decided to build a National Asset Register (NAR), that will capture all the assets owned by the government, including buildings, land, roads constructed by government, hospitals, schools, equipment and many others.

“We need to take a good inventory of these assets. The financial statement the federal government gives must be accurate, comparable and useful,” she said, adding that the financial statement needs to be useful because donor groups, investors and other international organisations that are interested in the Nigerian economy need to see the value of the country.

According to her, “Legacy asset management represents a pivotal tool for strengthening our fiscal position and alleviating our budgetary pressures.

“By systematically cataloging and valuing legacy assets, MDAs can unlock substantial value that would otherwise remain dormant.”

She warned that her office will initiate measures to enforce compliance, adding that sanctions will be applied to non- complying MDAs that continue to delay these critical renditions.

The AGF gave a deadline of December 31 2024 for all MDAs to submit their stand alone financial statements which is in three parts of statement of financial position, statement of financial performance and cashflow statement.

“We need that so that by the time we would be presenting the federal government account for 2024 we will be able to shift from a financial statement that we always get negative assets to the one that will have positive assets, meaning that our assets will be over and above our liabilities,” she further stated.

READ ALSO:

- Remittance Services in Africa: What Businesses Need to Know

- Sanwo-Olu suspends aide for revealing soldiers “executed” those who burnt TVC

- Duncan Mighty Acquires Brand New Lamborghini Urus Worth N620m

- Plumptre Elated To Make Super Falcons Squad For France Friendly

- Portable thrills participants at Abuja International Carnival